|

|

DRC uses a trading approach based on tools and concepts derived

from fractal geometry, a rich body of mathematics developed by Benoit

Mandelbrot. Fractal geometry has been used

to describe a wide variety of natural patterns and shapes from coastlines

to galaxies and including market prices.

The application of fractal mathematics to market analysis has revealed

both profound insights and useful tools. The primary insight, which

is supported by research conducted by Mandelbrot, Dreiss and others,

is that market prices are not random, but instead exhibit persistence,

the statistical tendency to continue in the same direction over

a wide range of time frames. This conclusion contradicts the standard

academic assumption (known as the efficient market hypothesis) that

markets are random, and provides rigorous support for the notion

that it is possible for dedicated and disciplined traders to profit

consistently from trading.

Since fractal analysis has shown that most markets exhibit persistence,

it is logical to pursue trend-following strategies as a means to

profit from this tendency. It seems natural to look again to fractal

geometry for tools to be used in designing these trading systems.

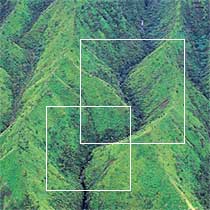

The defining characteristic of fractal patterns is that they are

self-similar across scale. For instance, a tree may have large branches

which branch into smaller branches and so forth, where each level

of branching displays the same general pattern as the previous level.

Similarly, it would be difficult to distinguish between hourly,

daily and weekly price charts if they were not labeled as such.

The Fractal Wave Algorithm was developed by Bill Dreiss and Art

von Waldburg to implement this logic of nested patterns in order

to provide a method for identifying trends and turning points which

is grounded in sound mathematical logic. The resulting Fractal Wave

System is free of numerical parameters and is therefore quite different

from numerically based systems, since it cannot be "optimized".

This approach thereby avoids the major danger to effective system

design, and provides a universal approach which is applicable to

virtually any market.

The assumption that the markets are fractal also has implications

for risk measurement and management. Standard statistical measurement

of risk relies on the calculation of the standard deviation of returns.

However, it has been shown that for fractal distributions, the standard

deviation is undefined, which means that it cannot be mathematically

calculated. This is due to the large number of unusually large moves

which occur across all time frames in real markets, a phenomenon

familiar to any market participant. The above reasoning reveals

an interesting paradox: If the markets are random, then risk can

be mathematically measured but there is no possibility of profiting

from trading, except by chance. On the other hand, if the markets

are fractal, it is mathematically possible to profit from trading

over a sustained period of time, but it is not possible to reliably

predict the risk involved in doing so.

|